Form I-134, Declaration of Financial Support, is required when sponsoring certain visa applicants, such as those applying for a temporary visitor visa or a K1/K2 fiancée visa. This form is to demonstrate that the applicant has financial support during their stay in the U.S. Even though this form is typically brought to the consular interview appointment, the consular officer may or may not review it, particularly if they believe the applicant lacks strong ties to their home country.

For fiancé visas, Form I-134 is important, and even minor mistakes can lead to delays, denials, or rejections.

What is an I-134 Form used for?

The I-134 Form demonstrates to the government that the visa applicant is being sponsored and will be financially supported by someone in the United States, eliminating the risk of them becoming a public charge (financial expense) to the U.S. government.

I-134 vs. I-864

Do not get this form confused with the I-864, Affidavit of Support, because they are different. Form I-864 is required for most family-based immigration cases, adjustment of status cases, and sometimes employment-based cases. The I-864 form is not intended for non-immigrant visas, and if you can demonstrate that you are employed in your home country and/or financially independent, you may not need to file Form I-134.

|

Feature |

Form I-134 |

Form I-864 |

|

Visa Type |

Temporary/nonimmigrant visas |

Immigrant visas/adjustemnt of status |

|

Income Requirement |

125% of Poverty Guidelines |

125% of Poverty Guidelines |

|

Legal Obligation |

Not legally binding |

Legally enforceable until sponsor or immigrant satisifes conditions |

|

Duration of Obligation |

No long-term responsbility |

Until the immigrant becomes a U.S. citizen |

|

Used for |

Non-immigrant visas (K-1, visitor) |

Family-based and employment-based immigrant visas |

Immigration can take a long time. VisaNation makes the entire process easy and fast!

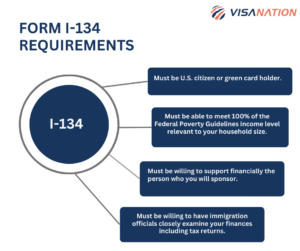

Form I-134 Requirements

The requirements to be an I-134 sponsor include:

- Must be a U.S. citizen or a green card holder

- Demonstrate income or assets at or above 125% of the Federal Poverty Guidelines for your household size

- Show that you are willing and able to provide financial support to the visa applicant during their temporary stay in the United States

These requirements are similar to the requirements for Form I-864. The difference is that Form I-864 is completed by family members for green card applicants, while Form I-134 is for applicants coming to the U.S. on a temporary visa.

What is the income requirement for the I-134 Form?

To meet the financial requirement, the sponsor must meet 125% of the HHS poverty guidelines for their household size, which includes themselves, dependents, and the visa applicant.

|

Sponsor's Household Size |

125% of HHS Poverty Guidelines* |

|

2 |

$26,437 |

|

3 |

$33,312 |

|

4 |

$40,187 |

|

5 |

$47,062 |

|

6 |

$53,937 |

Case example: Brooke is a U.S. citizen and she met her fiance Juan 3 years ago when she was vacationing in Brazil. She filed Form I-134 with the National Visa Center and submitted three years of past tax returns and evidence of her employment along with a letter from her employer saying she has worked there for five years and makes $50,000 annually. Brooke meets the income requirement and with the evidence she provided her case was approved for the K-1 visa during the interview.

I-134 Supporting Documents

As the sponsor, you need to provide evidence that you meet the financial requirements to sponsor a foreign national. If you fail to provide evidence demonstrating this, the I-134 will be denied. The following documents can be submitted:

- Most recent tax returns and W-2s

- Bank account statement showing the date the account was opened, the total amount deposited over the past year, and the current balance

- Statements from your employer (on business stationery) showing the date and length of time you have been employed, salary, and whether the position is permanent or temporary

- Self-employed individuals can provide a copy of their last filed income tax return or a report of commercial rating concern

- Documentation of bonds held with their serial numbers

Getting Family Green Cards is Easy and Simple with VisaNation

Types of Evidence to Provide

Evidence of financial ability can be submitted in the form of bank account statements, documentation from the sponsor’s employer indicating how much they get paid, length of employment, etc. An income tax return can also be submitted as proof.

To qualify, you must meet 125% of the Federal Poverty Guideline for your household size. To determine what your household size is, count any dependents, yourself, any relatives you live with, and the immigrant you intend to sponsor.

I-134 Instructions

Download the latest form I-134, complete the form accurately, gather supporting documents, write a cover letter (recommended), and send the form to the visa applicant

Step 1: Download the Latest Form

Go to the official USCIS website and download the most recent version of Form I-134, Declaration of Financial Support, to ensure you’re using the correct and updated form.

Step 2: Complete the Form Accurately

Fill out the form carefully, ensuring all information matches your legal documents. Double-check names, dates, and financial figures to avoid delays or rejections.

Need a legal team to review your forms accurately? Reach out to us!

Step 3: Gather Supporting Documents

Include proof of your ability to financially support the visa applicant, such as:

- Recent bank statements

- Tax returns or IRS transcripts

- Employment verification letter

- Pay stub

- Proof of assets (if applicable)

Step 4: Write a Cover Letter (Recommended)

Prepare a brief cover letter explaining your relationship to the visa applicant and a summary of the documents included. This helps the consular officer quickly understand your case.

Step 5: Send the Form and Documents to the Visa Applicant

Mail the completed Form I-134 with all supporting evidence to the visa applicant. They will bring this package to their U.S. consular interview

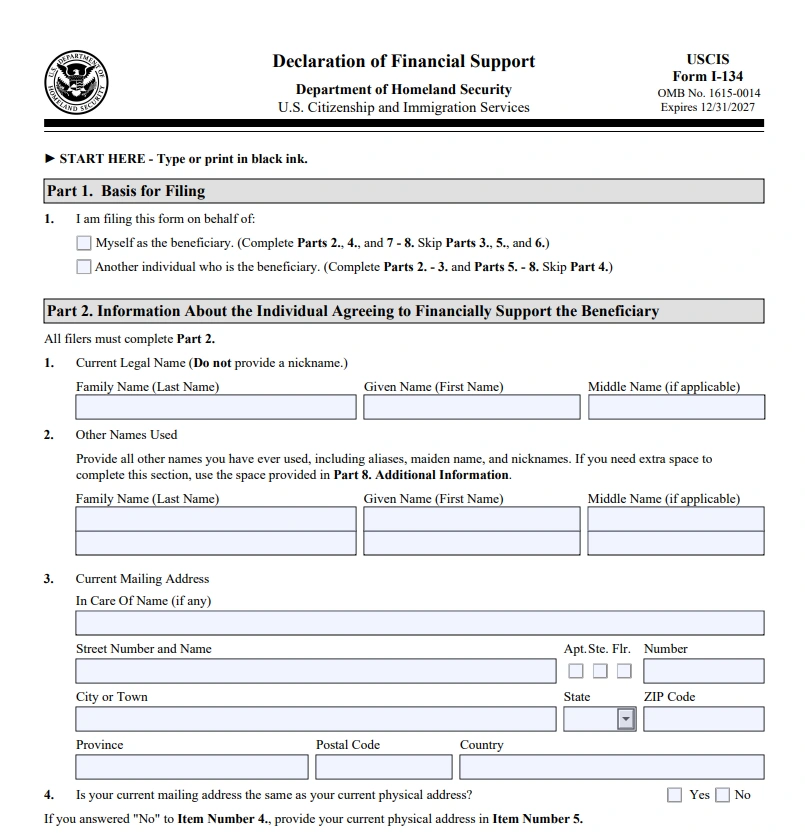

How to Fill Out Form I-134

The I-134 form is an important factor when determining a sponsor’s ability to support an immigrant and also whether the immigrant should be admitted to the United States on a visa or receive lawful permanent residency. For that reason, it is best to always complete immigration forms with the help of a qualified immigration attorney. All answers must be typed or printed legibly in black ink.

Part 1: Basis for Filing

Select if you are filing the form on behalf of the individual or if you are the beneficiary.

Part 2: Information About Your (the Sponsor)

The first section of the I-134 form is dedicated to basic information about you (the sponsor).

Fill in your full name, mailing address, physical address, date of birth, city and country of birth, Alien Registration Number (if applicable), U.S. Social Security Number (if applicable), USCIS Online Account Number (if applicable), and indicate if you are a U.S. citizen through naturalization or through parents/marriage.

If you derived your U.S. citizenship from another method, check box 11.c. If you have an Alien Registration number, fill it in on line 11.d., and if you are a lawfully admitted nonimmigrant, fill in your Form I-94, Arrival-Departure Record Number on line 11.e. In line 12, write your age in the first box and the dates since you have resided in the United States in the second box.

Part 3: Information About the Beneficiary

The second section is information about the immigrant beneficiary. Fill in their full name, date of birth, gender, Alien Registration number (if applicable), country of citizenship or nationality, marital status, physical address, beneficiary’s spouse (accompanying or following to join them), beneficiary’s children’s names, and their dates of birth and genders (if applicable).

Take away the stress, and worry less. VisaNation is here to review the I-134 and submit it seamlessly.

Part 4: Statement, Contact Information, Certification, and Signature of the Beneficiary

The third section requests information on your current employment and financial situation

- Indicate whether you are currently employed (and if so, the area of work and name of employer or self-employed)

- List the current employer’s street address, your annual income, balance of all savings and checking accounts in a U.S.-based financial institution

- Provide the dollar value of other personal property and the market value of stocks and bonds.

- If you have life insurance, fill in the sum of it on line 7.a. and the cash surrender value of it on line 7.b.

- If you own real estate, you need to complete the real estate section with the value of what you own, the dollar value of mortgages or other debts on line 8.b., and the location of the real estate.

If you, as the sponsor, have dependents, you need to complete the Dependents’ Information section. If you need additional space, it is provided in Part 7. Fill in the names, date of birth, and whether the dependent is wholly dependent on you for support or only partially. Do this for all dependents you claim on a tax return.

Get Green Cards for Your Family with VisaNation

Part 5: Sponsor’s Statement, Contact Information, Certification, and Signature

Before signing this section, read the Penalties section of Form I-134. Complete the Sponsor’s Statement by selecting box 1.a. if you can read and understand English, and understand every request in the affidavit.

If you used an interpreter, check box 1.b. and make sure they are named in Part 5. If you used a preparer, check box 2 and name them in Part 6. The next section is the sponsor’s contact information.

Fill in your daytime telephone number, mobile phone number, and email address. In line 6.a. – 6.b. sign and date the form.

Part 6: Interpreter’s Contact Information, Certification, and Signature

If you did not use an interpreter, you can ignore this section. If you did, fill in their name, mailing address, contact information, and they will need to sign and date in lines 7.a.- 7.b.

Part 7: Contact Information, Statement, Declaration, and Signature of the Person Preparing this Affidavit, if Other Than the Sponsor

If someone other than the sponsor prepared the document, they need to list their full name, mailing address, contact information, sign, and date this section.

Part 8: Additional Information

If you need extra space for any answers previously asked, use this section to do so. When you are finished completing everything, print or save a copy of the affidavit for your personal records.

*Important – If you are sponsoring more than one immigrant, you need to submit a separate Form I-134 for each foreign national.

What Does Public Charge Mean?

The 1999 Field Guidance definition of the public charge rule is a person who is or has become or is likely to become “primarily dependent on the government for subsistence, as demonstrated by either (i) the receipt of public cash assistance for income maintenance or (ii) institutionalized for long-term care at government expense.

USCIS is not considering an applicant’s receipt of Medicaid (except for long-term institutionalization at the government’s expense), public housing, or Supplemental Nutrition Assistance Program (SNAP) benefits as part of the public charge inadmissibility determination.” That means that short-term or special purpose cash payments, as well as short-term institutionalization, are not considered public benefits.

Under the rule, the only ones considered are “cash assistance for income maintenance” and “institutionalization for long-term care at government expense.” As with any case, the totality of circumstances is still taken into account when making a determination of an individual’s application.

Bring Your Family to the U.S.

I-134 Declaration of Financial Support FAQs

Is Form I-134 required for a visitor visa?

Form I-134 is not typically a required document for a B1/B2 visitor visa. However, a U.S. consular officer may request the form if they believe that the applicant cannot show enough personal funds to cover their trip to the U.S.

Finances play a significant role when applying for a tourist visa, and the DS-160 application asks about who’s paying the expenses for your trip and how much you earn each month. When you speak with the consular officer during your visa interview, they will check out your financial details. They’re trying to figure out if you can afford your stay and if you’re likely to head back to your home country after your visit, rather than staying in the US. According to Section 214(b) of the Immigration and Nationality Act, they start off assuming that anyone applying for a non-immigrant visa actually plans to stick around in the US for good. It’s up to you to show them that you’re not planning to immigrate and that you genuinely intend to leave the US once your short stay is up.

What is the I-134 form used for?

The Form I-134, Declaration of Financial Support, is used for an individual residing in the U.S. to sponsor a nonimmigrant visa applicant wishing to come to the U.S. The government needs to see that the sponsor has the financial means to support their temporary stay.

Who needs to fill out Form I-134?

The sponsor of an individual needs to be a U.S. citizen or resident (by law) and have enough financial resources to meet the requirements. They must also be willing to be financially responsible should the immigrant receive public benefits and the agency sue for the amount received.

Is Form I-134 required for an F-1 visa?

No, Form I-134 is not required for an F-1 visa. However, it can be used as an extra supporting document.

How much is the fee for Form I-134?

There is no filing fee for Form I-134.

What is the difference between Form I-134 and I-864?

Both are affidavits of support, but they are different. Form I-134 is normally used for non-immigrant visa cases to demonstrate that the visa applicant will not become a public charge and can obtain financial support while they are in the United States. The I-134 is not accepted for immigrant visa cases, with the exception of Diversity Visa applicants who need to demonstrate that they will not be a public charge if they do not obtain a job offer or have the necessary financial resources. Form I-864 is required for most family-based immigration cases, adjustment of status cases, and sometimes also employment-based cases to demonstrate that the immigrant will not become a public charge.

Where can I send my completed Form I-134?

The U.S. sponsor sends the completed I-134 to the visa applicant, who presents it at the consular interview abroad if the officer asks for it.

How long does it take for an I-134 to be approved?

The I-134 is typically submitted and reviewed together during the interview. Within 1-2 during the interview, it is approved.

Does Form I-134 need to be notarized?

No, the Form I-134 does not need to be notarized.

Can I use Form I-134 as a substitute for my personal financial information?

No, it is not a substitute. Consular officers will ask for proof of ties to your home country and may inquire about your personal finances, including your monthly salary and your ability to afford the trip to the U.S. if you are visiting on a B-1/B-2 visa..

What is the minimum income to sponsor an immigrant?

The minimum required income is 125% of the U.S. poverty level for your household size, and your household size includes any dependents, yourself, any relatives you live with, and the immigrant you intend to sponsor.

Is it a requirement for the sponsor to be related to the applicant?

No, the sponsor does not need to be related to the applicant. They just need to be a green card holder or a U.S. citizen and have the minimum financial earnings to qualify.