If you are living and working in the U.S. as an immigrant, you’ve probably wondered if you’re able to open a bank account to keep your money safe. The short answer is yes; you can open a bank account as a green card holder.

Opening A Bank Account As A Green Card Holder

While the requirements from bank to bank may differ, typically, you need a few things in order to open a bank account:

- An identification number such as a Taxpayer Identification Number or Social Security Number

- Proof of your physical address like a utility bill, lease, current driver’s license or government-issued ID

- Proof of your identity including name and date of birth (i.e., birth certificate, unexpired passport, consular ID card, government-issued driver’s license)

The banks need this information, by law, so they know exactly who their customers and their identity is verified by an official source.

Can I Obtain a Social Security Number?

The standard type of identification number that banks ask for is your social security number, but it is possible to open a bank account without SSN and instead use an Individual Taxpayer Identification Number (ITIN). These can be issued regardless of your immigration status and typically are received about six weeks after applying for them with the IRS. To confirm that the bank you want to open your account with will accept an ITIN number instead of a Social Security Number, it’s best to contact them directly and ask.

As a lawful permanent resident (or green card holder), you are eligible to receive a Social Security Number. Other types of immigrants that are eligible to receive social security numbers are individuals who have been granted asylum, individuals who have gone through the naturalization process and become U.S. citizens, and certain visa holders who came to the U.S. through employment-based immigration channels. You can visit a social security office to request a social security number. If you are a green card holder but don’t have a Social Security Number, you can also use a driver’s license, green card, or unexpired passport as a form of identification to open a bank account.

Opening a Bank Account Without a SSN

If you’re not eligible to receive a Social Security Number, then you may be wondering what options you have left to open a bank account. The good news is there’s another way to provide a bank with an identification number, and that’s with a Taxpayer Identification Number (ITIN). It’s best, however, to use a bank that has a physical branch if you choose this route because online banks may only have the ability to verify your identity with a Social Security Number.

Applying for a Taxpayer Identification Number

The Internal Revenue Service assigns Taxpayer ID numbers to foreign nationals living and paying taxes in the United States. You can apply for this number at the same time that you file federal taxes with the IRS. To submit your Taxpayer ID number application, you will need to provide:

- A completed Form W-7 (these are available in both English and Spanish)

- Proof of identity that is not expired and that has a photo of you on it like an unexpired driver’s license or passport

- Proof of association to your foreign country like an unexpired passport

- Completed federal tax return

Note: For all of these documents, you must submit an original document or a certified copy. A certified copy is one that is signed by an authorized person who has seen the original document and will vouch that it is accurate and honest.

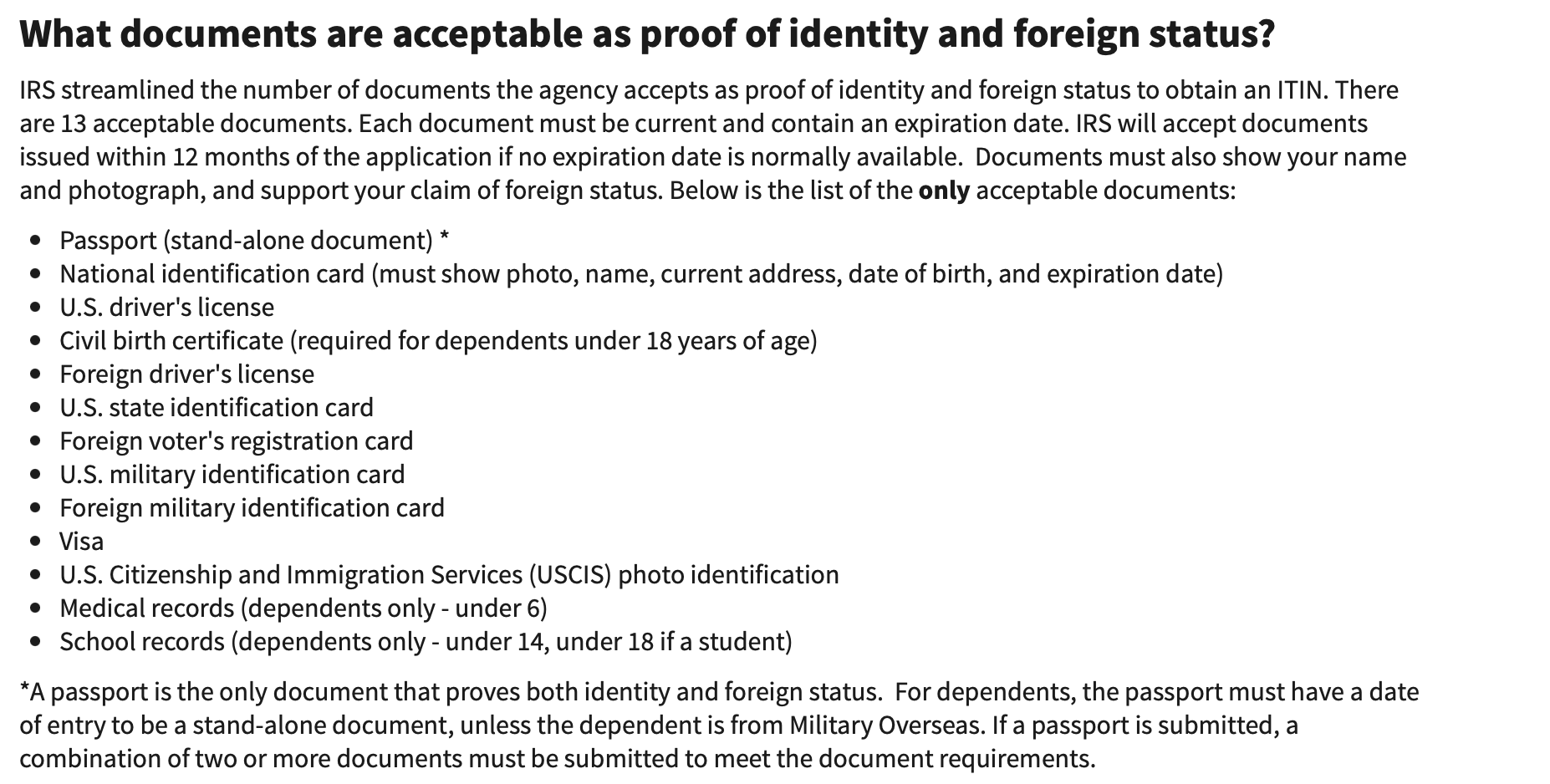

Additional forms of proof of identity and foreign status can be seen below. Be aware that an Individual Taxpayer Identification Number is different from an Employer Identification Number (EIN). An EIN is used to identify a business entity.

Reasons to Open a Bank Account in the United States

There are many reasons it could benefit you to open a bank account in the United States. The first being safety. When you deposit your money into a bank account, you have peace of mind that it won’t be stolen in a home burglary or lost in a catastrophic event like a fire or flood since the bank insures your funds. It’s also unsafe to keep large sums of money on your persons because it makes you a target of attack. Another reason it’s wise to open a bank account is that it establishes financial history, which can later be used to show goodwill in applying for loans, getting credit cards, buying a home, etc. If you have children, some states also allow you to open a college savings plan (529 plan) that has tax benefits. What’s more, having a bank account allows you to pay bills using online transfer tools and also cash checks.

Can DACA Recipients Open a Bank Account?

If you are the recipient of the Deferred Action for Child Arrivals Program (DACA), then you can open a bank account with a Taxpayer Identification number along with proof of address and other forms of identification. Review the section above to learn how to apply for an Individual Taxpayer Identification Number.

BB&T Bank is one financial institution that welcomes DACA recipients with open arms. With BB&T, you can:

- Open a checking account

- Plan to save for college

- Get resources on financial literacy

Learn more about BB&T’s offerings for DACA recipients on their website. If you’re unaware of your current immigration status and if you qualify to open a bank account as an undocumented immigrant, it’s wise to consult an immigration professional.

Shilpa Malik

Shilpa Malik  Sabrina Saada

Sabrina Saada