If you’re petitioning someone to come to the U.S. and you don’t meet the income requirements not only do you need to fill out an I-864 but also Form I-864A, Contract Between Sponsor and Household Member. This form shows that there is an eligible member of the household willing to combine their resources (income and/or assets) with the main sponsors to meet the financial requirements. Our guide will take you through I-864a instructions, joint sponsor and household member definitions, and more. VisaNation makes the entire process seamless and easy. Get started today!

It’s Easy and Simple to Get Family Green Cards with VisaNation

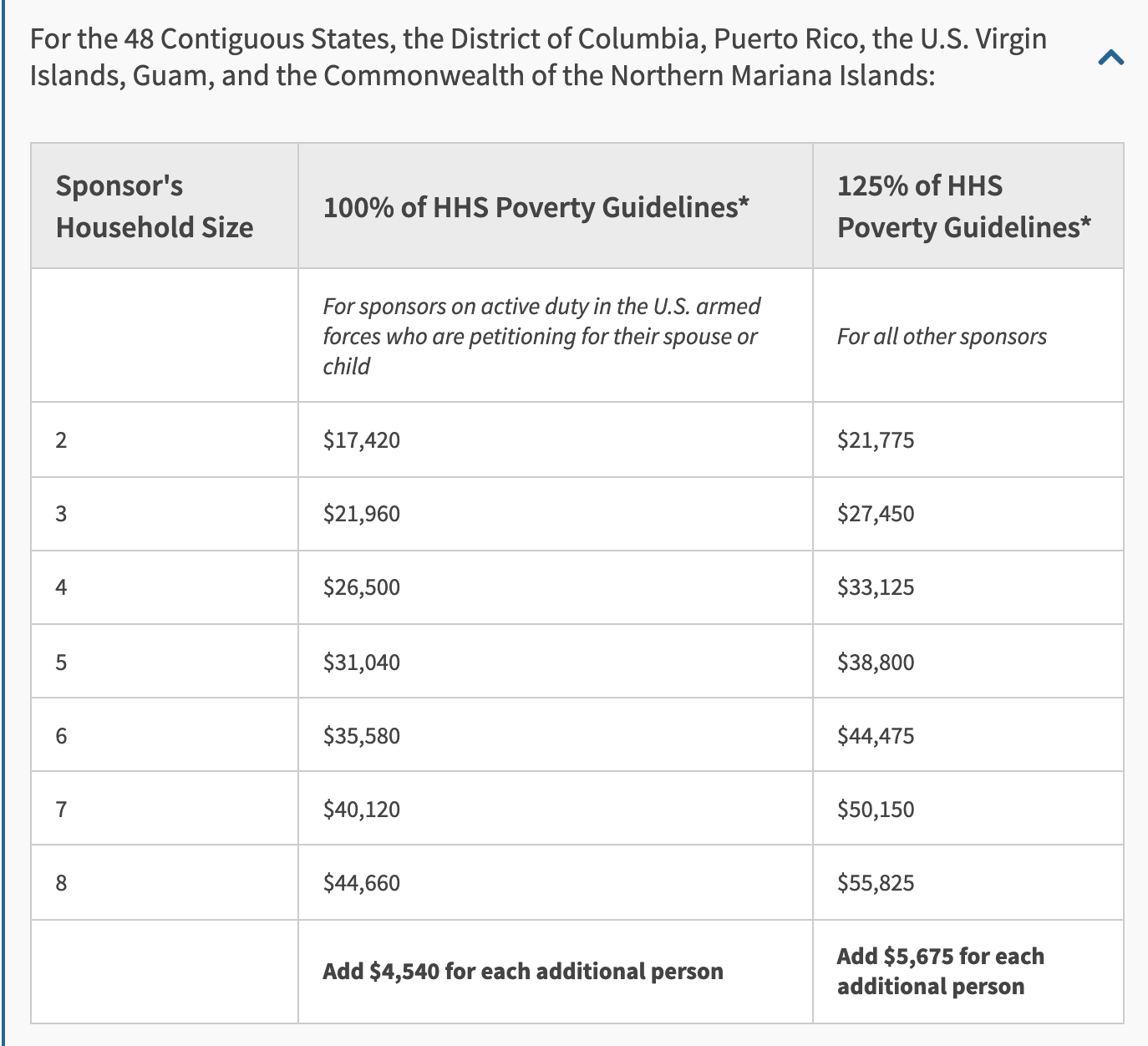

Form I-864A Instructions

Are you trying to sponsor a relative or spouse to immigrate to the United States? If you answered yes, you more than likely will need to complete Form I-864, Affidavit of Support, accepting financial responsibility for the sponsored immigrant until they either become a U.S. citizen or fulfill 40 quarters of work (approximately ten years). If your income does not satisfy the requirement, equal to or higher than 125% of the U.S. poverty level for your household size, then you have the option to include a household member or dependent’s income and/or assets to meet the income requirement, should they decide to accept the financial liability.

Let’s say, for example, the sponsoring petitioner wants their fiancé from Brazil to immigrate to the United States, but unfortunately, their income does not satisfy the requirement. If the petitioner lives with a relative or dependent, like a son or daughter, who works regularly and is willing to combine resources with the main sponsor to meet the financial requirement, then they can do so by submitting Form I-864A along with the I-864. They must file these forms together.

If a government program provides the sponsored immigrant with any financial assistance based on need, both sponsors would be responsible for paying back the monies to the government within a certain period of time. However, be aware that if the government decides, either one of the sponsors could be responsible for paying back the entire amount because the liability is considered “joint and several.”

Complete Your Green Card Application Today

Who is Considered an Eligible Household Member in I-864A?

Not just anyone can sign Form I-864A. To be considered a household member for the Contract Between Sponsor and Household Member, the individual must be at least 18 years old and meet one of the following:

- Be the parent, adult child, spouse, or sibling of the main sponsor and live in the same physical residence as them

- Be lawfully claimed as a dependent by the main sponsor in their most recent federal tax return; not required to live in the same principal residence

- The immigrant can pool financial resources with the petitioning sponsor only if the petitioning sponsor intends to rely on the immigrant’s continued income to satisfy the financial support requirements.

- For this situation to be considered, one of two scenarios must occur:

- The intending immigrant must have the same principal residence as the sponsor. In addition, they need to demonstrate that their income will continue (from a legal source), even after obtaining lawful permanent residence. That means if the immigrant is working without legal authorization to do so, they will not be eligible by USCIS’ standards OR:

- The intending immigrant is the main sponsor’s spouse, and again they need to demonstrate that their income will continue (from a legal source), even after obtaining lawful permanent residence

- For this situation to be considered, one of two scenarios must occur:

Multiple individuals can decide to provide financial support for the sponsored immigrant, but they must sign a separate Form I-864A.

Form I-864A is an attachment to Form I-864. The I-864A should be completed if a household member is willing to contribute to the primary sponsor’s income to meet the financial requirement equal to or above 125% of the U.S. poverty level for their household size. If a joint sponsor agrees to co-sponsor the immigrant, then they complete a separate I-864. Are you just thinking about securing a green card for your spouse or a relative? Let VisaNation assist you throughout the entire process. Create your application today!

What is the difference between a joint sponsor and a household member?

A joint sponsor and household member are not the same things. A joint sponsor is also willing to accept legal responsibility for supporting the intending immigrant. They must meet the same criteria as the main sponsor (125% income requirement without pooling incomes with the other petitioning sponsor). However, they do not need to be related to the immigrant. They would need to complete a separate Form I-864, Affidavit of Support, not Form I-864A.

Reunite with Your Family

I-864A Instructions Step-by-Step

Form I-864A consists of eight pages and should be filled out by the household member agreeing to sponsor the immigrant along with the primary petitioning sponsor. All answers should be typed or printed in black ink. The top section labeled For Government Use Only should be left blank. If an attorney or accredited representative completes the form, the attorney will need to write in their State Bar Number.

Section 1: Information About the Household Member

The first part of the form asks for basic information about the household member who has agreed to pool income with the primary sponsor. Fill in the full name, mailing address, physical address, date of birth, place of birth, Social Security Number (if applicable), and USCIS online account number (if applicable). Do you have questions related to family-based immigration? We can help you with the entire process, from start to finish. Start today!

Section 2: Household Member’s Relationship to the Sponsor

If you are the intending immigrant and also the sponsor’s spouse, check box 1.a. If you are the immigrant and also a member of the sponsor’s household, check box 1.b. If you are related to the sponsor as a spouse, son or daughter, parent, brother, sister, or other dependent and not the immigrant but part of the sponsor’s household, check the appropriate box in 1.c.

Section 3: Household Member’s Employment and Income

In this section, the household member must answer questions regarding current employment, whether self-employed, unemployed, or retired. Plus, write the household member’s current individual income amount in line 7.

Section 4: Household Member’s Federal Income Tax Information and Assets

This section requires the household member to indicate whether they have filed a federal income tax return for each of the three past years. You will need to attach a photocopy or transcript of the most recent federal income tax return with the form and have the option to include tax returns up to three years in the past if you believe it will help your case. This section also indicates the household member’s total income (adjusted gross) reported on these tax returns. If you are counting additional assets to meet the financial requirement, indicate the values in lines 3.a–3.d.

Section 5: Sponsor’s Promise, Statement, Contact Information, Declaration, Certification, and Signature

The primary sponsor will need to print their name and agree to support the immigrant listed on this form, in conjunction with the household member promising to accept liability under the Affidavit of Support. Following the sponsor’s promise, the intending immigrant’s full name, date of birth, Alien Registration Number, Social Security Number (if applicable), and USCIS account number (if applicable) need to be written. If additional immigrants are being sponsored through this form, fill out their information as well.

If an interpreter aids in completing this form, the sponsor must declare they read every question and instruction to them. If the sponsor can read and understand English and did not have a preparer or interpreter, check box 26.a. The rest of this section asks about the sponsor’s contact information, followed by a declaration and certification of the information and documents provided.

Increase Your Green Card Approval Chances with VisaNation

Section 6: Household Member’s Promise, Statement, Contact Information, Declaration, Certification, and Signature

The household member should have a thorough understanding of the penalties involved with agreeing to sponsor the intending immigrant considering the Affidavit of Support. These considerations include:

- Promising to provide any/all financial support necessary to assist the sponsor in maintaining the sponsored immigrant at or above the minimum income provided for in the Immigration and Naturalization Act (no less than 125% of the Federal Poverty Guidelines) during the period the Affidavit of Support is enforced

- Agreeing to be jointly and severally liable for any payment owed by the sponsor under the Affidavit of Support to any Federal Government agency, any local or state agency, or local or private entity that provides means-tested public benefits to the immigrant

- Declaring under penalty that the Federal income tax returns you submit are true copies or unaltered transcripts filed with the IRS

- If you (household member) are also the sponsored immigrant, then you agree to be jointly and severally liable to any obligation owed by the primary sponsor under the Affidavit of Support to any of your dependents, Federal agency, organization, or entity that provides means-tested benefits or financial support to assist the sponsor in maintaining your dependents at no less than 125% of the Federal Poverty guidelines

- If you are related to the sponsored immigrant or the sponsor by marriage and the marriage ended, you would still be responsible for the obligations in Form I-864A

- By consenting to this form, you also authorize the Social Security Administration to release information about you in its records to the Department of State and USCIS

The rest of Section six is similar to Section five. If an interpreter aids in completing this form, the household member must declare that they read every question and instruction to them.

Section 7: Interpreter’s Contact Information, Certification, and Signature

If you used an interpreter, provide their full name, business/organization, mailing address, contact information, and certification in this section.

Section 8: Contact Information, Declaration, and Signature of the Person Preparing this Contract, if Other than the Sponsor or Household Member

If you used a preparer, provide their full name, business/organization, mailing address, contact information, and certification in this section.

Section 9: Additional Information

This section is included should you need additional space for any previous questions.

You should provide the following documents along with Form I-864A:

- Copy of sponsor’s most recent federal income tax return or IRS transcript

- A copy of every W-2 form and 1099 that corresponds with the sponsor’s most recent federal income tax return, if you provided that

- Tax returns for the past three years if you believe it will support your case

Get a Green Card for Your Relatives

Frequently Asked Questions

What is considered household size?

The household size is determined by counting yourself, any dependents or relatives living with you, and the intending immigrant.

Who is considered a sponsor?

A sponsor is defined as either a petitioning relative (with or without ownership interest in the intending immigrant), a substitute in cases where the original sponsor dies, a joint sponsor. Businesses, organizations, and enterprises cannot be considered a sponsor – only an individual can.

What is the minimum income to sponsor an immigrant in 2021?

The answer depends on the size of your household, which includes yourself, any dependents, and relatives living with you in addition to the immigrant you are sponsoring. You can see the complete 2021 Poverty Guidelines here. If your household size, for example, is four people, then the 125% income requirement is at least $33,125. The requirements differ slightly for residents of Alaska and Hawaii.

What should I do if I can’t meet the income requirements?

A qualified immigration attorney is best suited to help you evaluate your options if you cannot meet the income requirements. Still, some of your choices include adding in the cash value of your assets (i.e., savings accounts, bonds, property), getting an eligible household member to help you sponsor the intending immigrant by pooling your income together or counting the income/assets of members of your household who are related to you through birth, marriage or adoption (they must be listed as dependents on your most recent tax return and lived with you the past six months). Another option is to count the assets of the immigrant relative you are sponsoring.

Can my roommate sign the I-864A?

Unless the roommate is a relative, parent, adult child, spouse, or sibling of the main sponsor or lawfully claimed as a dependent on your most recent federal tax return, then they cannot sign it.

If I include the immigrant I am sponsoring as a household member on Form I-864, do they need to file Form I-864A?

If the intending immigrant’s income is included with the sponsor’s income on Form I-864, then they would only need to complete the I-864A if they have accompanying dependents. However, if only the immigrant’s assets are included on Form I-864, then they do not need to complete the I-864A even if they have accompanying dependents.

What is the filing fee for Form I-864A?

There is no fee to file Form I-864A with USCIS.

Do I have to attend an interview with USCIS?

In some instances, USCIS can require an interview or that you provide your fingerprints, photo, or additional information to verify your identity.

Shilpa Malik

Shilpa Malik