Did you know that a financial sponsor is essential for a successful green card application? Whether it’s your petitioner, a family member, or a friend, they must submit Form I-864, the Affidavit of Support. This guide is your complete resource for the I-864, explaining its requirements, answering common questions, and providing clear instructions on how to fill it out properly.

Increase Your Green Card Approval Chances with VisaNation

What is the I-864, Affidavit of Support?

The Form I-864, Affidavit of Support is primarily used in family-based green card applications to demonstrate that the sponsor has sufficient financial means to support the immigrant to ensure they do not become dependent on U.S. government assistance.

It is a legally binding contract, meaning that once the sponsor signs and the green card is approved, the sponsor becomes legally obligated to financially support the immigrant. In this case, the sponsor is the person who filed the petition on behalf of the immigrant.

This form must be filed with USCIS if you are a U.S. citizen or legal permanent resident planning to sponsor a spouse or family member coming to live in the United States.

The financial responsibility only terminates if the sponsored immigrant:

- Becomes a U.S. citizen

- Is “credited with 40 quarters of work,” which typically equates to about ten years.

- Permanently departs the United States, abandoning their permanent resident status.

- Passes away.

Am I Financially Responsible for My Immigrant Spouse After Divorce?

If you submit an I-864 for marriage green card, a divorce does not dissolve you of financial obligation. Therefore, it is not something to be taken lightly – you should carefully consider if you are willing to sponsor the immigrant long-term.

Reunite with Your Family

Who Is Required To Submit Form I-864?

The U.S. citizen or lawful permanent resident who filed the I-130 on behalf of the immigrant is responsible for submitting Form I-864. In addition to the petitioner, the following individuals may also be required to submit an Affidavit of Support:

- Joint Sponsor: A joint sponsor is a person who agrees to share the financial responsibility of sponsoring an immigrant. The joint sponsor must meet the income requirement independently (125% of the poverty guideline), and this can be any U.S. citizen/U.S. Lawful Permanent Resident. A joint sponsor is commonly used when the primary sponsor does have the financial resources.

- Substitute Sponsor: A substitute sponsor is a family member who steps in when the original petitioner has passed away. A substitute sponsor must:

- be either a U.S. citizen or a permanent resident

- be at least 18 years old

- live in the U.S.

- meet the financial threshold of a sponsor listed under INA 213A.

- be related to the immigrant in some way, such as a spouse, parent, child, sibling, in-law, grandparent, etc.

- assume the legal and financial obligations as the original sponsor.

Immigrant Categories Requiring Form I-864:

Immediate Relatives

This includes sponsors for spouses, parents, children, and siblings. It doesn’t matter if the sponsor’s income is in the millions; everyone must still submit an Affidavit of Support to show that the immigrant will not become a public charge.

Family Preference

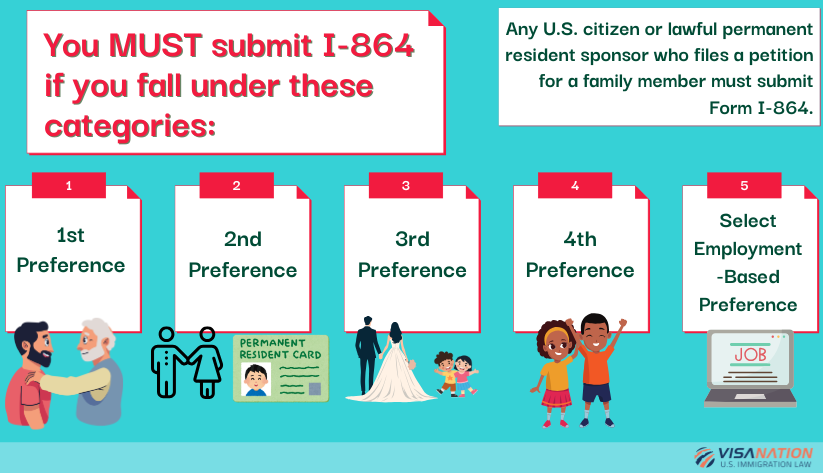

All immediate relatives of a U.S. citizen who fall under one of the following preference categories are required to submit Form I-864:

- First Preference: Unmarried adult sons or daughters (21 or older) of U.S. citizens

- Second Preference: Unmarried sons or daughters and spouses of permanent residents, as well as their unmarried children

- Third Preference: Married sons and daughters of U.S. citizens, along with their spouses and unmarried minor children

- Fourth Preference: Siblings of adult U.S. citizens, along with their spouse and unmarried minor children

- Select Employment-Based Preference: Some immigrants in certain employment-based categories would need to file if a U.S. citizen or permanent resident relative filed their petition, or their relative has “significant ownership interest 5% or more in the entity that filed the petition.”

Who is Exempt From Filing Form I-864

There are exclusions where an individual does not need to file Form I-864, Affidavit of Support. To qualify for the exclusion, they would need to demonstrate one of the following:

- Have worked or can be credited with 40 qualifying quarters (as defined in Title II of the Social Security Act)

- Are the child of a U.S. citizen, and if admitted for permanent residence on or after February 27, 2001, would automatically acquire citizenship under Section 320 of the Immigration and Nationality Act, as amended by the Child Citizenship Act of 2000

Are you just thinking about securing a green card for your family?

I-864 Income Requirements for 2025

There is an income requirement that the sponsor, joint sponsor, or substitute sponsor has to meet. It is based on the U.S. poverty level guidelines and the number of individuals living in the household. To qualify, you need to show income equal to or higher than 125% of the U.S. poverty level for your household.

A household includes you and any dependents and relatives living with you, along with the immigrant you are petitioning.

Below are the 2025 Poverty Guidelines for the 48 contiguous States. The exceptions to this rule are if you don’t live in the 48 contiguous states and are not on active military duty.

2025 Poverty Guidelines (125% of HHS)

Poverty Guidelines for 48 Contiguous States

|

Poverty Guidelines (48 Contiguous States & D.C.) |

|

|

Number of Household/Family Members |

125% of HHS Poverty Guidelines |

|

2 |

$26,437 |

|

3 |

$33,312 |

|

4 |

$40,187 |

|

5 |

$47,062 |

|

6 |

$53,937 |

|

7 |

$60,812 |

|

8 |

$67,687 |

|

For more than 8 people add $6,875 per person |

|

Complete Your Green Card Application Today

Poverty Guidelines for Alaska

|

Poverty Guidelines for Alaska |

|

|

Number of Household/Family Members |

125% of HHS Poverty Guidelines |

|

2 |

$33,037 |

|

3 |

$41,637 |

|

4 |

$50,237 |

|

5 |

$58,837 |

|

6 |

$67,437 |

|

7 |

$76,037 |

|

8 |

$84,637 |

|

Add $6,875 for each additional person Source: USCIS 2025 HHS Poverty Guidelines for Affidavit of Support |

|

Poverty Guidelines for Hawaii

|

Poverty Guidelines for Hawaii |

|

|

Number of Household/Family Members |

125% of HHS Poverty Guidelines |

|

2 |

$30,400 |

|

3 |

$38,312 |

|

4 |

$46,225 |

|

5 |

$54,137 |

|

6 |

$62,050 |

|

7 |

$69,962 |

|

8 |

$77,875 |

|

Add $7,913 for each additional person Source: USCIS 2025 HHS Poverty Guidelines for Affidavit of Support |

|

Exceptions for Military Members

If you are on active duty in the U.S. Army, Marines, Navy, Air Force, or Coast Guard and you are petitioning your immediate family member, you will only need to demonstrate an income at 100% of the poverty level for your household size. Typically, sponsors need to demonstrate at least 125% of the poverty level, but not for active duty members.

How to Fill out I-864 if Unemployed or Low-Income?

If you have no income or it is below the minimum requirement, you can:

- Add a joint sponsor: This can be any U.S. citizen who meets the income requirements and agrees to take on the financial responsibility.

- Count Assets: Savings, property, stocks, or other valuable assets can be used.

- Use Immigrants’ Assets/Income: In some cases, the immigrant’s own income or assets may be counted toward meeting the Affidavit of Support requirements, provided the income will continue after obtaining permanent residence or the assets are readily available to support them.

How to Fill Out Form I-864: Step-by-Step Instructions

You must follow specific instructions when filling out your I-864. Failure to do so may result in your application being rejected or a significant waiting time to fix the mistakes.

Part 1: Basis for Filing Affidavit of Support

The first section of the form has you establish why you are filing the affidavit of support. You must select one of the following options

- If you are the petitioner and filing it for your immigrant relative, check box 1.a.

- If you filed an alien work permit on behalf of your relative, check box 1.b. and indicate what your relationship to them is.

- If you filed an alien worker permit for the immigrant relative, but do not personally employ them, but are in charge of over 5 percent, then check box 1.c.

- If you are one of two or the only joint sponsor, you will select box 1.d. or 1.e.

- Finally, if the original petitioner is deceased and acts as the substitute sponsor, check 1.f.

Part 2: Information About The Sponsor

The second section asks for details about the sponsor, including their:

- name

- mailing address

- date of birth

- and phone number.

According to VisaNation, one tricky question asked in part two is about the country of domicile. The core requirement for a financial sponsor is that they must be domiciled in the United States.

Many U.S. citizens live abroad and want to sponsor a relative. You can still do this, but you cannot list the foreign country as your domicile. You will need to prove your stay abroad is temporary.

There are exceptions, which are listed below in the Frequently Asked Questions section. If you are a member of the United States military, be sure to include that in this section.

Part 3: Information About the Principal Immigrant

Section three asks questions about basic questions about the principal immigrant, including name, address, A-number, USCIS account number, and nationality.

Part 4: Information About the Immigrants You Are Sponsoring

Part 4 is all about the family members being sponsored.

In question one:

- if you (the sponsor) are sponsoring the principal immigrant listed in Part 2, you should check “Yes.”

-

If you are acting as a joint sponsor (meaning another sponsor already covered the principal immigrant), you check “No.”

You will also specify whether you are sponsoring any other additional family members, fill out the names and personal details of each family member in addition to the principal immigrant (if applicable).

Be sure not to include a family member if they have not been listed on the principal immigrant’s visa petition (based on the approved Form I-130).

Start your green card application

Part 5: Sponsor’s Household Size

The purpose of part 5 is to determine your household size, which informs the government what the minimum income requirement should be for the financial sponsor/s.

Ensure you carefully read each option and if appropriate include any dependent children if you have sponsored other people on a previous Form I-864 who are now lawful permanent residents. Also, include if you have siblings, parents, or adult children living in your residence whose income is combined on Form I-864A.

Part 6: Sponsor’s Employment and Income

Part 6 is where you provide details about:

- your employment

- occupation

- employer

- and annual income

- assets/income of the immigrant (if applicable)

- and information about anyone else who is combining their income with yours to sponsor the immigrant relative.

If using income from others, their name, relationship, and income must be listed, and they may need to complete a Form I-864A. The form requires calculating the “Current Annual Household Income” by totaling all individual incomes listed. This total is what will be compared against the Federal Poverty Guidelines.

Important: Be aware that you will need to provide copies of federal income tax returns, so always be accurate in your answers.

Part 7: Use of Assets to Supplement Income

This section should only be completed if the sponsor’s total household income listed in Part 6 is insufficient. It allows the sponsor to demonstrate financial ability by listing the value of their assets, their household members’ assets, and the principal immigrant’s assets.

Scroll down to Frequently Asked Questions to learn how to calculate your assets’ necessary value to meet the financial requirements.

Parts 8-11: Sponsor/Interpreter/Preparer’s Contact, Statement, Contact Information, Declaration, Certification, Signature, and Additional Information.

Part 8 contains the sponsor’s legally binding contract, which outlines their financial support obligations , the consequences of not fulfilling them , and the specific conditions under which these obligations will end. This section also includes the sponsor’s contact information, a statement certifying the accuracy of the information provided, and the sponsor’s signature.

Part 9 is to be completed by an interpreter, if one was used, and requires their contact information and a signed certification of their fluency and the accuracy of the interpretation.

Similarly, Part 10 is to be completed by a preparer, if one assisted, and includes their contact information and a signed declaration that the affidavit was prepared at the sponsor’s request using information the sponsor provided.

Finally, Part 11 provides additional space for any information that could not fit in the other sections of the form.

What Supporting Documents are Needed for the I-864?

While the exact supporting documents may vary depending on your case, here is what all sponsors are required to submit:

- Proof of U.S. Status: The sponsor must submit proof of their U.S. citizenship, U.S. national status, or lawful permanent resident status.

- Federal Income Tax Return: The sponsor must attach a photocopy or an IRS-issued transcript of their federal income tax return for the most recent tax year.

- Optional Additional Tax Returns: If the sponsor believes it will help their case, they have the option to submit tax returns for the three most recent years

- Form I-864A for Household Members: If the sponsor is using the income of other household members to meet the financial requirements, each of those individuals must complete and sign a Form I-864A, Contract Between Sponsor and Household Member, to be filed with the I-864

- Any W-2s or statements

- Form 1099 or any statements of reported income

- Evidence of income/assets

You may be required to submit these documents from multiple past years. If you are self-employed, be prepared to provide copies of your Schedule C, D, E, or F. You should go through the required document list before submitting your application.

Making an error when filing your Affidavit of Support can cause substantial delays and often rejections if not filed properly. For that reason, it is always advisable to have an experienced immigration lawyer carefully review your case and submit the appropriate documentation to USCIS.

See Your Eligibility for a Green Card

I-864 Processing Times and Fees

How Long Does the I-864 Take to Process in 2025?

The I-864 doesn’t have its own independent processing time. It’s reviewed as part of the overall green card application.

In other words, factors such as background checks, National Visa Center (NVC) backlogs, or embassy delays can affect how quickly your I-864 is processed. To avoid unnecessary delays, it is crucial to complete the I-864 accurately, since errors or missing information often trigger Requests for Evidence (RFEs) and can prolong your case.

Get A Family Green Card

Form I-864 Cost

The cost to file Form I-864, Affidavit of Support, depends on whether you are adjusting status from inside the U.S. or applying from abroad

- $0 if filing within the U.S. with USCIS for adjustment of status

- $120 if filing with the National Visa Center (NVC) for consular processing.

How Long is an Affidavit of Support Valid?

The I-864 affidavit is valid until the immigrant:

- Becomes a U.S. citizen

- Has earned (or can be credited with) 40 quarters of work in the U.S. (about 10 years of qualifying work, as tracked by the Social Security Administration)

- or leaves the U.S. permanently.

An Affidavit of Support will be considered insufficient if the sponsor fails to meet the poverty guidelines or if the consular officer cannot verify the stated income.

Separately, the I-864 form itself will be rejected if its edition date is outdated when you file, which requires you to submit the petition again using the most current version of the form.

Frequently Asked Questions

Below you will find answers to the most commonly asked questions about I-864 Form.

Who needs to file I-864?

If you are a U.S. citizen (or legal permanent resident) planning to sponsor a spouse or family member coming to live in the United States, then you need to file an I-864. Any co-sponsors must also file the I-864A.

How much does form I-864 cost?

This depends on your immigration path. For immigrants already in the U.S. adjusting status, there is no filing fee to file the I-864 with USCIS. For immigrants abroad, applying through consular processing incurs a fee of $120.

What can I do if I do not meet the income requirements?

If you are not able to meet the minimum income requirements, you have a few options. The first is to add the cash value of assets you possess, including savings accounts, property, bonds, or stocks. The necessary value of assets required for you to qualify is calculated by subtracting your household income from the minimum income requirement. The cash value of your assets needs to be worth at least five times the difference. You could, for example, include the net value of your home as an asset. To calculate the net value, you would take the appraised value and subtract any mortgages or amounts not paid back yet. Likewise, you could take the net value of your car by subtracting any loans from the market value.

If the intending immigrant is the spouse of a child (18 or older) of a U.S. citizen then the minimum cash value of the assets needs to be three times the difference of the household income and 125% of the poverty guideline. The other exception is if the immigrant coming to the U.S. is an orphan being petitioned by U.S. adoptive parents. In that case, the assets need to equal or exceed the difference between 125% of the poverty line and the household income.

Other options, if you cannot meet the minimum income requirements, include the assets or income of people in your household who are your dependents. To take advantage of this option, the person must be listed as a dependent on your recent federal tax return and must have lived with you past six months. The last option is to count the assets of the relative you are sponsoring.

When do I submit the I-864?

The timing depends on whether the immigrant is applying for a green card from inside or outside the United States

If Applying Inside the U.S. (Adjustment of Status), you submit the Form I-864 alongside the Form I-485, Application to Adjust Status. For many family members, the I-130 petition, the I-485 application, and the I-864 are all filed at the same time. You do not wait for the I-130 to be approved first.

If Applying Outside the U.S. (Consular Processing), you submit the Form I-864 only after the initial Form I-130 petition is approved. The approved petition will be sent to the National Visa Center (NVC), which will then contact you to submit the I-864 and pay the $120 fee.

What can I include in my total income calculation?

You can include the following sources of income to calculate your total income:

- salaries and wages

- retirement benefits

- alimony

- child support

- dividends

- interest earned

- any other income

Note that your total income will also be the same number on line 9 of IRS Form 1040 for the tax filing year.

Can my immigrant relative's income be counted towards the financial requirement?

Yes, you can include the income of the relative you are petitioning to meet the requirement assuming that they will continue earning that same amount after coming to the United States. You can also use the value of their assets even if the assets are outside of the U.S. There are additional requirements to use foreign assets, however. They must be considered liquid or easily made into cash within a year. The assets must be able to move to the United States. The assets' total value must equal five times the difference between the sponsor's income and poverty guidelines. So, for example, if the difference is $10,000, then the total value of the assets must be a minimum of $50,000.

Can foreign income count for the income requirement?

If you, as the sponsor, live outside of the U.S., you cannot count the foreign income towards the requirement unless you can demonstrate that you will have the same earnings when you move to the U.S. or have another job that meets the financial requirements.

Can I submit I-864 electronically?

It depends on your immigration path.

If the immigrant is applying for their visa from outside the U.S., you will typically submit the Form I-864 and all supporting documents electronically through the Consular Electronic Application Center (CEAC) portal.

If the immigrant is already in the U.S. and is filing Form I-485 to adjust their status, the process is different. This path requires a physical paper filing. The Form I-864 is included with the other application forms and sent by mail to a USCIS Lockbox facility

What is a joint sponsor I-864?

A joint sponsor is someone willing to share the financial responsibility of the intending immigrant along with the primary sponsoring petitioner. They must meet the financial requirements (125% income requirement alone). They do not, however, need to be related to the immigrant.

Joint sponsors need to understand that the I-864 is a legally binding contract.

Who is considered a member of my household?

Anyone you claim as a dependent on a tax return + the immigrant you are sponsoring. If the immigrant is bringing a child with them, that also needs to be included in the household size.

What are the I-864 income requirements?

The sponsor must have an income of at least 125% of the Federal Income Poverty Guidelines for their household size.

You can refer to the USCIS guidelines to determine the income requirement.

If I get a divorce am I off the hook for financially supporting my immigrant spouse?

No, if you get a divorce, the financial sponsorship obligation does not dissolve until the immigrant either becomes a U.S. citizen or is credited with 40 quarters of work (comes out to about ten years), or the sponsored individual dies/ leaves the United States.

What happens if I change my address after becoming a sponsor?

If you change your address after becoming a sponsor, you are required by law to notify USCIS within 30 days. Otherwise, you could be fined.

What is "income deeming"?

Income deeming is the process by which a sponsored immigrant may be "ineligible for certain federal, state or local means-tested public benefits because an agency will consider the resources and assets of the sponsor (and the sponsor’s household member, if applicable) when determining the immigrant’s eligibility for the means-tested public benefits program," like Social Security.

Can employment abroad be considered a U.S. domicile?

If you are a U.S. citizen but currently living outside of the United States, some types of employment can be considered U.S. domicile. These include:

- Jobs temporarily stationed overseas with the U.S. government

- Jobs temporarily stationed overseas with a U.S. institution of research recognized by the Secretary of Homeland Security

- Jobs temporarily stationed overseas with a U.S. firm or corporation (or subsidiary) in the development of foreign trade/commerce with the U.S.

- Jobs temporarily stationed overseas with a public international organization where the U.S. engages by treaty or statute

- Jobs temporarily stationed overseas with a religious denomination or group having a bonafide organization within the U.S.

- Jobs temporarily stationed overseas as a missionary by a religious denomination or group within the United States

If my relative's interview is delayed, will the I-864 expire?

No, the form will not expire and is considered 'indefinite' from the time the sponsor signs it. So even if the immigration process is delayed for your relatives, your I-864 will not expire.

Are any other factors taken into consideration for my case's approval?

Although you may meet the minimum financial requirements, the fate of your case is in the hands of the USCIS or consular officer, who will review the totality of your situation to gauge the immigrant's probability of becoming a public charge. Other factors include the health, age, skills, and status of both the sponsor and intending immigrant.

What is the difference between I-864 and I-864EZ?

The I-864EZ is a shorter version of the I-864. You can use Form I-864EZ only if all of the following factors apply to you:

- You filed Form I-130, Petition for Alien Relative, for the relative immigrant you are sponsoring

- The alien relative you are sponsoring is the only person listed on the I-130

- The income you earn that is qualifying you to sponsor the person is entirely your own salary or pension and can be proved with IRS W-2 forms provided by your current or former employers

If any of the following conditions apply, then you should NOT use I-864EZ and instead use Form I-864:

- The relative you want to sponsor is not the only person immigrating to the U.S. on that visa petition

- You are filing an I-140, Immigrant Petition for Alien Worker, for your relative

- You are a joint sponsor

- The original I-130 petitioner is deceased and you are acting as a substitute sponsor

- You do not meet the financial requirements based on the Federal Poverty Guidelines