Background

Both of our clients, Abdul and Marissa, lived in California. Abdul was born in Afghanistan and came to the United States as a child. He became a naturalized U.S. citizen in his teenage years and had built an entirely new life in California.

Three years ago, Abdul met Marissa when she joined his IT consulting team. Marrisa was working for the company in the UK but had transitioned to the U.S. team to complete a new project. They are both passionate about problem-solving in the field of Artificial Intelligence. They ended up working on the same project, and that’s how they got to know each other better. Their lunch breaks turned into dinner dates, and over time, their connection deepened. After three years together, Abdul decided to take a leap of faith and propose to Marissa. She said yes, and this is when the couple reached out to our office to discuss the next steps for Marissa.

VisaNation Case Strategy

At the time, Marrisa was living and working in the U.S. under an H-1B visa, and still had three more years left on her visa. Since Abdul is a U.S. citizen, we could file an adjustment of status petition for Marissa. This would allow Marissa to obtain a green card without having to leave the U.S.

Our strategy focused on creating a well-documented filing that clearly demonstrated Marissa’s eligibility and the bona fide nature of their marriage. We prepared all the necessary forms and supporting evidence, including:

- Proof of shared residences (Lease)

- Joint finances (Bills, Rent payments, Car payments, etc.)

- Employment documentation

- 5-10 photos taken together

- Planned itineraries of trips taken

However, everything with the case was on track until an issue with the tax documents came up.

Issue

No one could have anticipated the California wildfires that occurred in early 2025. These wildfires swept across the Palisades, destroying homes and displacing thousands of residents. Unfortunately, Abdul’s house fell within one of the danger zones and was completely lost to the fires.

The disaster not only took an emotional toll, but a financial one. Abdul lost access to important records, including his most recent tax returns. Normally, this could cause delays with green card applications. However, our team used Abdul’s previous three years of tax returns and attached an official IRS memo granting tax relief to wildfire victims in California. This documentation clearly showed that Abdul’s missing tax returns were due to circumstances beyond his control.

Despite the hardship, the couple remained hopeful, and we stayed determined to move their case along.

Verdict

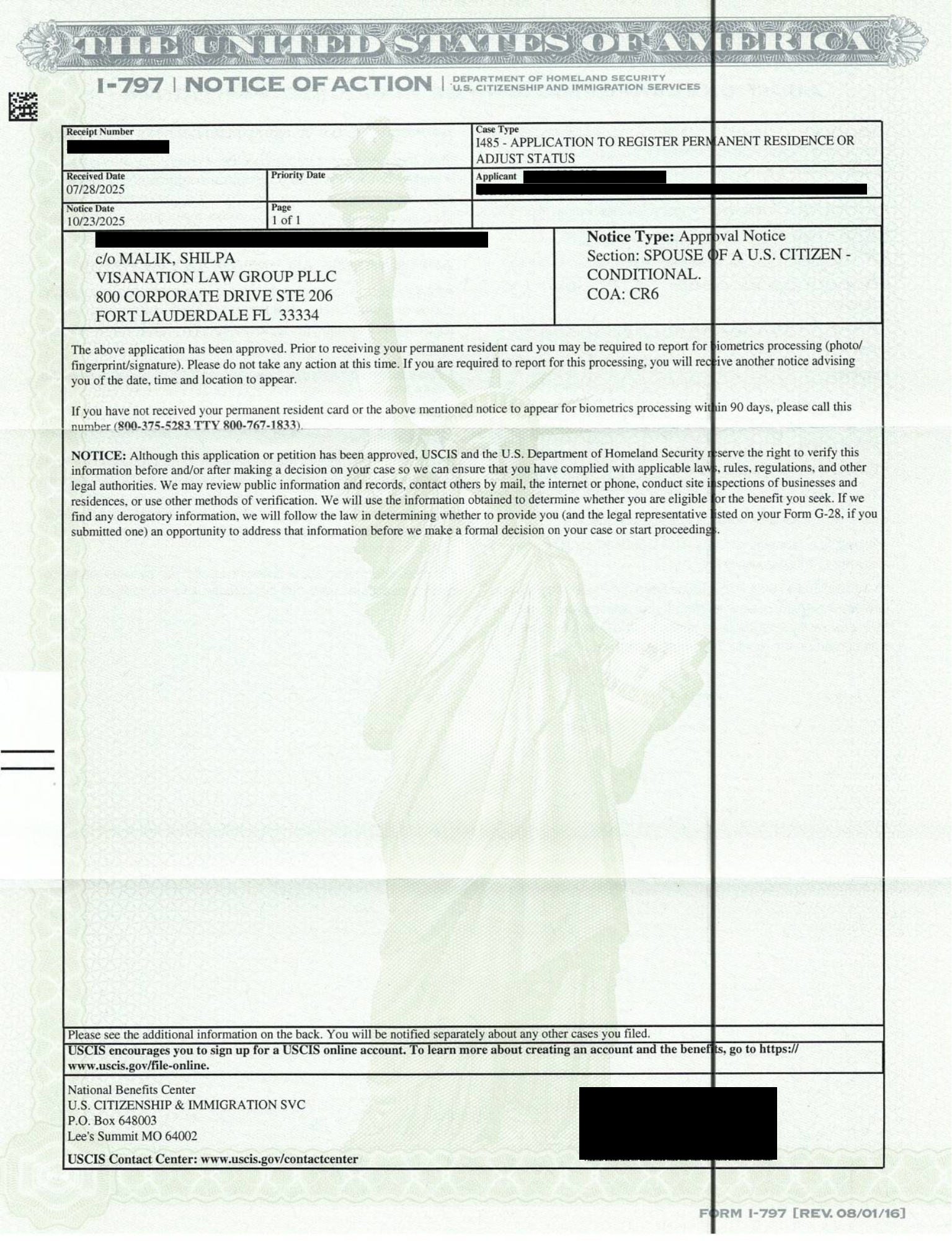

USCIS approved the green card within 2 months of filing the adjustment of status! No RFEs or any delays occurred with their petition.