Background

Our client, Mr. Luca, served as the Chief Operating Officer of a fast-growing financial technology startup in Latin America. Also known as a fintech company. The company had quickly established itself as a key player in digital payments, mobile banking, and international financial platforms. With its success in the region, the company wanted to expand into the United States. The U.S. was a popular spot for financial modernization and inclusion, particularly for underserved communities.

As Chief Operating Officer, Luca has been instrumental in shaping the company’s growth strategy, overseeing its financial stability, and driving expansion into international markets. His leadership role positioned him as the ideal candidate to head the U.S. operations and bridge financial infrastructure gaps between Latin America and the United States.

VisaNation Case Strategy

After careful evaluation, our VisaNation team determined that an L-1A visa was the most appropriate visa for Luca. This visa is designed for Intracompany Transfer Executives or Managers, who are being transferred from a foreign office to a U.S. office of the same organization. Luca would be leaving Brazil to come to the U.S.

The U.S. fintech entity was wholly owned and controlled by a U.S. company, where the multinational holding company also owned the Latin American parent company. This qualifying corporate relationship was a critical requirement for the L-1A petition. We demonstrated that under Luca’s leadership, the company was not just expanding geographically. The company was strategically transferring advanced fintech solutions innovations developed in Latin America to serve U.S. markets. His role in overseeing operations, driving technology adoption, and fostering partnerships was central to this transfer of expertise.

For a strong L-1A petition, it is important to showcase both the qualifying business relationship and the executive nature of the role. To do this, we provided a comprehensive package, including:

- Tax documents

- Corporate registrations providing the shared ownership structure

- Business plans

- Proof payments, bank statements, and lease agreements

- Contracts with clients and partners

- Pay records

- Website details and marketing materials illustrating the company’s services and vision

We also highlighted the growth in the company, due to Luca as the COO, who increased the clientele from fewer than 20 to over 70 institutional clients. He also grew the transaction volumes beyond $750 million and helped implement Brazil’s Open banking infrastructure.

Issue

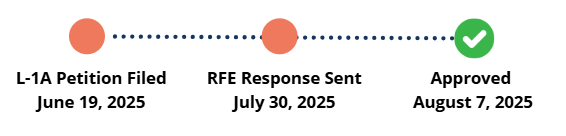

USCIS sent our office an RFE, which has been very common in 2025. The RFE said that we needed to provide more evidence to show how Luca met the preponderance of the evidence in the L-1A petition.

This was something our team was ready to handle, as we knew we had already submitted evidence. So, we resubmitted the same evidence and highlighted how each supported Luca’s eligibility for an L-1A visa. We further explained his executive role, leaving no room for any questioning.

Verdict

Without a doubt, USCIS approved the L-1A petition! All within 2 months, and this approval validated the strength of our legal strategy and the clear importance of Luca’s executive role in bringing innovative fintech solutions from Latin America to the United States.